St. Paul chooses Oppidan for makeover of downtown Macy's

By Kristen Leigh Painter Star Tribune

The Macy’s building whose closure 2 ½ years ago put a drag on St. Paul’s reviving downtown was jolted back to life Friday.

The St. Paul Port Authority, the building’s overseer, named Oppidan Investment Co. to be master developer of a remodeling that would turn the old Macy’s into the practice site of the Minnesota Wild as well as the home of offices, retailers, a brewery, restaurants and bars.

“We are all excited about this,” said Louis Jambois, president of the Port Authority. “Having a development partner who has the financial capability to do this was the final trigger. Having the Wild a part of the project has been a real attractive presence to generate excitement from other prospective tenants.”

The building is a hulk — 515,000 square feet including basement and parking — that’s been vacant in the middle of downtown since early 2013.

It has proved more challenging to remake than the Port Authority anticipated when it purchased it in January 2014. With the appointment of a master developer, city leaders hope other pieces will fall into place for a renovation estimated to cost $50 million to $60 million.

“This specific location, in the heart of the central business district and adjacent to the Central Station transit hub, holds incredible opportunity,” St. Paul Mayor Chris Coleman said in a statement. “When I asked the Port Authority to take on this project, it required extraordinary effort.”

With virtually no windows above street level, the stone-clad building is a less than desirable to tenants in an age of floor-to-ceiling windows and sun-drenched rooms.

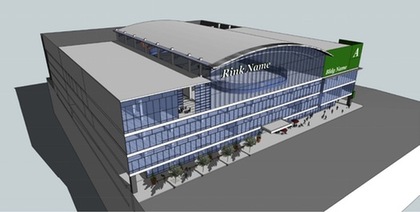

The building will be given a new skin, industry parlance for exterior surface materials, and holes will be punched for windows. Early design renderings from the Port Authority, which Oppidan will closely mimic, show a glassy atrium-like wall along Wabasha Street.

Also included in the site plan is St. Paul’s worst kept secret: a new Walgreens in 25,500 square feet at the building’s southwest corner. That area, which includes both street- and skyway-level space, is under purchase agreement by an entity associated with Minneapolis-based Capital Real Estate for $2.5 million.

The Port Authority has a handful of tenants who have submitted letters of intent to sign a lease, but that was contingent upon a broader development occurring. Basically, no one — including Walgreens — wanted to be the only occupant in an otherwise abandoned building. By securing a developer, the Port Authority expects to convert those letters into signed leases.

“That’s an integral part to this. We need the tenants. They are there, and now we just have to finish the deals,” said Paul Tucci, vice president of development for Oppidan.

Some of the existing retail space will likely be converted to parking, leaving about 200,000 square feet of leasable space.

The Wild has been interested in the site for months, but also were waiting for assurances of a larger project. The team’s interest alone prompted other businesses to consider the location.

“We have said from the beginning that this needs to be multiuse, something for the community that brings a lot of activity. That’s where Oppidan comes in,” said Jamie Spencer, the Wild’s vice president of new business development. “We are not starting from scratch. We’ve done a lot of work with the Port Authority and spent a lot of time moving this from an interest to an actual deal.”

The Wild’s practice rink would have to be added to the building’s roof “because no one wants to skate around columns” that support the structure, Jambois said.

“It’s a really structurally sound facility. It’s not fetching, but very structurally sound,” he added.

The Port Authority is asking Capital City Properties, a nonprofit subsidiary of the authority, to approve a joint venture with Oppidan. CCP bought the property from the Port Authority in June for $1.

Oppidan will have a 90 percent ownership and CCP will have 10 percent.

“There is going to have to be significant financing on this project, and Oppidan will ultimately be the one on the greatest financial hook. So the relationship is based on who is taking the risk,” Jambois said.

About $11 million will come from tax increment financing if the St. Paul City Council and its Housing and Redevelopment Authority approve it next month.

Oppidan, based in Excelsior, was selected from a pool of candidates with ideas for the site. The Port Authority was in final negotiations with two developers — the other from out of state — this week.

“We crossed the big hurdles, now the fun part begins,” Tucci said.

The Port Authority formed CCP in 1991 to handle its joint partnerships when repossessing property or foreclosing on businesses.

Tuesday’s board meeting will set up the parameters for moving forward with a joint-venture agreement.

CCP has entered into five joint-venture partnerships over the past 12 years, including with Frauenshuh at Westminster Junction, Wellington Management at River Bend, Interstate Partners at Beacon Bluff, Ryan Norris Circle LLC at Energy Park and later United Properties also at Energy Park.

If approved, the joint-venture group hopes to begin construction in the spring with a target date for completion sometime in 2017.

Posted in: Press Releases

Media Inquires Contact: [email protected]