How the St. Paul Port Authority rescued the Macy's site

It wasn’t an impossible assignment. It just seemed that way.

The St. Paul Port Authority was asked to buy an abandoned mid-century department store in the heart of downtown. It then had to shift gears after Plan A — demolition — proved too pricey. Instead, it would have to search for a developer and new tenants for a homely, windowless box that was built for a different use, in a different era.

Oh, and hurry up about it. Once Macy’s moved out, the shuttered store had become soul-sucking dead space in a downtown that was seeing private and government-financed redevelopment on its edges in Lowertown, around West 7th Street and Rice Park, but little at its center.

“About a year ago we had nothing going,” said Lee Krueger, the authority’s senior vice president of development. That was just after port staff received the “sticker shock” of a $13 million demolition estimate that, on top of the $3 million purchase price, made that option unaffordable.

St. Paul Mayor Chris Coleman is knowingly understated when he says: “That’s a difficult building.”

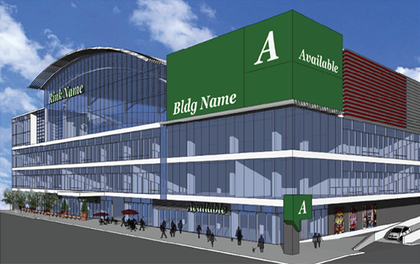

Yet since that low point, the port authority — drafted into service by Coleman — might just have pulled off something of a miracle. It is in the midst of unveiling a series of business deals that could transform the old store into a downtown centerpiece. Called (for now) the “Wabasha and Sixth Street Building,” the $50-to-$60 million renovation of 510,000 square feet will feature a top-floor practice facility for the Minnesota Wild, ground-floor retail, restaurants and a brewery, as well as mid-building software, medical and financial services offices.

It will be owned and operated by a joint venture between a port subsidiary and an Excelsior developer. If plans go as outlined, a building that looks nothing like its current condition will open in early 2017. If it works, it will be a rare example of a former downtown department store being successfully repurposed for private uses.

A unique joint venture

“We knew we had to do something significant on that site,” Coleman said. The project was a test, he said, of whether all of the public investment made in light rail, in Lowertown and other parts of downtown would pay off.

Coleman is having a good week, having all-but-secured hosting privileges for a Major League Soccer stadium and unveiling designs for what is being called the River Balcony: a connected public and private walkway on the bluff overlooking the Mississippi in downtown St. Paul.

While the port authority had hoped to pass the building onto a private developer, the deal outlined to the port’s board is something different. Through the port’s subsidiary, Capital City Properties, it will form a joint venture with Oppidan. The port will contribute the building it purchased from Macy’s in January of 2014 plus the value of the staff work done to recruit tenants and a developer.

Oppidan will put up $5.3 million and the joint entity will borrow the rest of the estimated $52 million redevelopment costs. Part of that borrowing will be in the form of an $11 million tax increment financial deal offered by the port authority, paid back at interest for 25 years out of the increased property taxes generated by the higher assessment of the building. The TIF loan, which needs city council approval, triggers a city ordinance that all workers on the project receive living wages: between $12 and $15 an hour depending on whether health benefits are included.

Coleman said the details of the financing, including the TIF, are still being looked at. But he said the city recognizes that the project is challenging and added “there might be a role for the city.”

The two partners will share lease revenue commensurate with their investment, 90 percent for Oppidan and 10 percent for the port. The port will also act as the broker for the project — delivering tenants as well as naming rights in exchange for commissions. And if the building doesn’t make money, the risk will be borne by Oppidan, according to the terms negotiated so far. But if Oppidan has to put in more money, its share of the ownership will increase.

Port Authority President Louis Jambois said the port expects to more-than break even on the deal, something not common in its more-typical ventures that involve environmental brownfields. In addition to the rent and the brokerage fees, the port has already agreed to sell 25,000 square feet of street front on Wabasha for $2.5 million to a “national retailer” that is known to be Walgreens.

Wild's involvement key

Jambois said the Walgreens piece created some momentum, as did the interest from the Wild in building a practice facility on the upper stories of the building. The 15-year-old franchise has never had an exclusive practice space, which left it searching for an ice sheet when Xcel Energy Center was being prepared for other events.

“The Wild were very helpful,” Jambois said. “The restaurant folks are excited because the Wild will be there. The health care folks are excited because they Wild will be there.” He said the additional tenants will be announced over the coming weeks and months “when they ink” their leases.

Timing of the deals was vital, Krueger said. Tenants wanted to know the project was real and that it would attract developer interest. Developers in turn wanted to know there were tenants interested. Navigating what he termed the chicken or the egg dilemma was tricky.

Since last week’s announcement, however, “people who would not take our phone calls 12 months ago are now returning our calls,” he said.

Hometown flavor

In addition to the hometown NHL team, there also is a St. Paul flavor to the project. Paul Tucci, the vice president of development for Oppidan, grew up in east St. Paul and was in the then-Dayton’s department store frequently. He said he worried that he was looking at the numbers of the project more-favorable because of his bias toward the city.

“I’ll be very honest with you,” he told the board, “I sat down with our people at a meeting and said, ‘Tell me I don’t have my St. Paul blinders on.’” But he thought the number worked and a major selling point was the work the port staff has already done to recruit tenants.

“We’re excited,” Tucci said. “There are still some things to be completed. We need to roll up our sleeves and get going.”

Coleman also said he hopes the project along with city investment into renovating the nearby Palace Theater will spur additional development in the core. One obvious target is the surface and underground parking across Wabasha that sits beneath a dangling skyway that could be connected to the Macy’s renovation.

The mayor praised the work of the port, but was also forced to alter his vision for the site when the demolition costs came is so high last year. He had favored a tear-down and a new building on the block in order to take advantage of the just-opened light rail line and its Central Station.

Ideas focused at first on one or more big-box retail tenants that would fit into the inward-looking store, but there was little interest. Finding that the ugly exterior walls could be removed, and that windows could replace the bricks, opened up the building to tenants that crave daylight, such as offices and restaurants.

One potential blip in the plans came more than a year ago when a historic analysis of the area done as part of Green LIne light rail construction said it could be eligible for the National Register of Historic Places an example of mid-century architecture.

Based on the analysis, the St. Paul Heritage Preservation Commission urged the port authority to save the 1963 building. While the building is being saved, all of the exterior features — those elements typical protected by being on the register — will not be kept. A nomination was never made to the commission; and had the building been declared historic, the type of renovation deemed necessary to attract new tenants would not have been permitted.

Posted in: Press Releases

Media Inquires Contact: [email protected]